It’s 2008 the sub-prime mortgage market has collapsed and banks aren’t lending. The government needs to get some juice back into the economy and get people spending. It doesn’t want the citizen to lose out simply because of mistakes made at the higher echelons of society.

London Wants to be the Fintech Capital of the World

In my previous blog I wrote about Tel Aviv’s regulatory challenges in dealing with industry changes. I am delighted to see that the financial regulator in the UK, the FCA has set up an initiative, Project Innovate to help innovative finance companies. Members of Parliament, such as Mark Hoban have challenged fellow politicians, business leaders and regulators to be aware of the challenges of financial disruption. Creative means are necessary in order to help grow digital finance, which is taking place rapidly in London’s backyard. A great portion of the startups in London’s emerging Tech City are finance orientated. eToro is part of the new Finance Innovation (video below check it out!) programme that intends to make London a leader in financial services (we saw this summer the country still sucks at football :)).

30 years ago London established mechanisms and an infrastructure that allowed it to become the world’s banking centre. Our office in the UK is located in Canary Wharf, now London’s financial hub, previously a wasteland. The Finance 2.0 of today is designed to have a positive effect on consumers. It will remove the fees that our burden our lives (like having to pay 8% to change money at the airport!) and will create a frictionless environment in order to deal with our finances. Finance will be in the hands of the individual rather than the middle man. In the long run this individual empowerment can only be a good thing. If it is the regulator’s responsible to protect the consumer, the regulator should embrace these positive changes rather than stifle them.

It is great to see engagement and understanding taking place between the FCA and Fin-Tech startups and established businesses. It is great they have also acknowledged that innovative companies see current regulations as outdated and complex. This acknowledgement will hopefully pave the way for regulatory changes that can allow innovation to flourish.

We hope that this dialogue expands into a blossoming working relationship that will turn London into the world’s fin-tech capital, strengthening the UK’s economy for many years to come.

The Startup nation’s digital finance revolution

I had the awesome opportunity of speaking at the Geektime Conference this month, on a panel talking about whether Israel could become a hub of global fintech. The internet company I founded, eToro has it’s RnD centre here in Tel Aviv as well as a corporate office in London. These are two markets where digital finance is starting to flourish and can become a serious player in their respected nations economies.

The Tel Aviv tech boom over the past 25 years has been represented by 3 waves of innovation. The 1st, the large software companies such as Magic Software :), Amdocs and Comverse emerged in the 80s. The 2nd wave in the late 90s was represented by the dot.com boom, with hundreds of startup companies emerging and 50 Israeli companies floating on the Nasdaq. Today’s 3rd wave of innovation here in Israel is significantly represented by internet and digital finance in the form of payments, investments, fraud detection and crypto currency startups. Finance is a trillion dollar industry and there is no reason Tel Aviv cannot have a piece of this pie, the same way that London become the world’s banking centre. Financial innovation will be a major disruptor in years to come. As recognised by Google’s Chairman Eric Smidt who met a number of these companies when he visted Tel Aviv earlier in the summer.

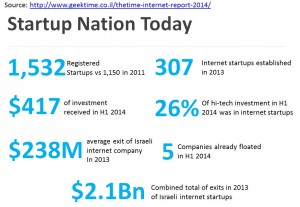

Geektime put together some cool stats (translated below) that shows the growth of internet startups in Israel over the past year

In order for this growth to be sustained and accelerated governments need to adapt their own regulation and oversights in sync with innovation. For instance I truely believe that Bitcoin will move from a rogue technology to a major financial organ in global economics. Lawmakers need to embrace this. By embracing these trends that will become apart of our future, and having Tel Aviv become a central hub of Bitcoin trading the wider national economy can grow. With it’s innovative culture as highlighted above, Israel is perfectly placde to be a global leader by embracing the essence of Finance 2.0. That’s if it sorts out certain regulatory and industrial obstacles. My blog post from last year on Regulation 2.0 is even more relevant today as it was back then.

Snapchat worth 10 Billion USD … I thought it was crazy at 3.

Remember last year, when everyone was going nuts over Snapchat’s rejection of Facebook’s 3bn offer to buy the company? a few thoughts I had about this when reading this week’s news :

1) Private is the new social, this week Snapchat’s valuation has reached $10bn. It has tripled Facebook’s valuation within one year alone, and despite pessimists saying that the Whatsapp aqusition will kill the young company, no one can argue that it has became one of the social giants of our time. 10B USD worth of sexting . OK, its more its people communicating with crappy photos realizing there is no reason to save them also.

2) Evan Spiegel (23 yr old CEO of Snapchat) thinks sexting is GOOD and that it can stay private, While Mark Zuck thinks “The Age of Privacy is Over” . Seems you can be social and private at the same time, act social and leave not even a single trace of evidence behind. Who will prevail? probably both. We have TV’s and Radio , and we also still have print – different mediums for different content.

3) Mobile Only…..

4) I am old (33) and married (+3), I have no use of sending lots of things that need to be deleted. But if, like hundreds of celebrities, you are sexting and sending nude images of yourself, they better self distruct them…

While last year everybody was rushing in to explain why Snapchat is crazy to turn down the offer, today no one is calling out the $10bn valuation as being absurd, in fact Dick Costello tweeted this, “Snapchat at $10b not absurd. Crazy growth, clear monetization path, & one of the best social product thinkers out there…” and I think we can all agree that Dick knows what he is talking about when it comes to the social revolution.

I know I’ve said it a million times before, but reality keeps reminding me that we’re on the right path- these companies are still just early adaptors of this phenomena called social networks, and this field will keep growing in the years to come.

Moonshots in Faraway Places: Why Eric Schmidt called me an idiot

Eric Schmidt believes it and so do we.

Technology will soon enable people to have all the information they need in the palm of their hands regardless of wealth status. He has set up a fund Innovation Endeavours intended to invest in the Israeli and US entrepreneurial ecosystem and I was honored to be invited to have dinner with him when he recently visited Tel Aviv. A diverse range of entreprenurs were present representing the best of the Israeli tech ecosystem. Coming from different industries and backgrounds these entrepreneurs helped shed light on the many facets of Israeli innovation and creativity, these included to name a few: Mickey Boodaei CEO of Trusteer (acquired by IBM), Ido Bachelet Phd and Assistant Professor in Life Sciences at Bar Ilan University, Sagie Davidovich CEO Spark Beyond (artificial intelligence), Ofer Haviv, President and CEO Evogene, Maxine Fassberg CEO Intel Israel.

It was a privelege to hear Eric’s views on innovations and the future of tech. Being the chairman of Google he rules the world 🙂 and has a unique vantage point to speak from. Eric told us about his travels and his visits to China, Berlin, London and even Iraq, that he travles a lot seeing Google at work everywhere around the world. He questionsed a lot the people around the table about what makes Israel the “startup nation” (I suppose he got his answer by the chutzpah on show :)). He mentioned several times that Israel is second only to Silicon Valley by the intesity and diversity of entrepreneurship. Unsurprisingly as the table was full of Israelis each person was not afraid to give their own personal opinion and insights. Being Israeli entrepreneurs they explained to him that he is wrong, that there are many problems and reasons that Israeli startups can’t succeed, why the goverment is wrong (in their policies on tech) and education system is rotten (there is a large braindrain with many Israeli top academics now based abroad). I guess Eric’s experience with different cultures led him to understand that the Next Google can come from Israel. I was the only optimistic around the table, saying if Bitcoin can become a huge economy growing out of nowhere with no home, then obviously huge things can come out of the smallest places like our country.

On that note I asked Eric whether Google will support and adopt Bitcoin. It will, so will there be a Googlecoin and if so Googlecoin bank? Google will not go into financial services so no Google bank anytime soon and no threat to eToro in becoming the world’s largest mass market digital finance institution 🙂

When I asked if Android will remain free and open? He said of course, anyone who says it isn’t is an idiot…well there you go conspiracy theorists 🙂

In case Eric Schmidt was unaware which country he was in one entrepreneur closed the dinner by explaining to him that Google’s future was uncertain since they are not using his technology and are suffering from NIH syndrom (not invented here). Eric was humble and suggested to benchmark Google technology vs his company’s tech.

So with the internet of things and emerging technologies will the next big thing be from a faraway place unknown to most, outside of the traditional superpowers? Eric Schmidt believes so. Watch this space…

The Virtual Social Network

Experience the impossible. Interact with those that are not around you, experience their experiences. Facebook intends to take sharing to a new level with its 2B USD acquisition of the virtual reality headset company, Oculus.

Facebook intends to be at the forefront of a new medium of interaction; virtual reality. Its acquisition is symbolic. Facebook embodies openness and sharing among individuals rather than exclusivity and secrecy. Its purchase of Oculus will put a technology that will greatly disrupt the way we live in the hands of social networks rather than individuals, benefitting communities rather than just ourselves. The social network revolution has allowed technology products to reach optiminal distrubution in a fast, efficient manner. Facebook’s acquisition will hopefully accelerate the ability for Oculus products to reach distribution and benefit the mass market in a quicker manner than other innovations (electric cars for example that have taken many years to reach mass market consumers).

I remember sitting at university and telling my parents how I used a podcast to watch my lectures. They were bemused. I could record, rewind, learn and watch when I liked. But it seems we are about to go 180. I am going to go back to the classroom to learn, but not physically, via a pair of googles. Rather than watching the sport on TV, I am going to virtually be there. Rather than using virtual reality to escape into a world of our own, Facebook’s culture and vision (here is Mark Zuckerberg’s FB post about it) will allow us to interact virtually while sharing these experiences with one another.

Critics will say this will create a more lazy society, but to me this will transform the actions that we currently perform via the TV,PC, tablet and mobile. It will disrupt and transform the activities that are already embedded in our daily lives such as watching a music video, a live sports event or lecture on YouTube.

Facebook is the first mover in dominating a market that will play a major role in our lives. Their ability to dominate our digital ecosystem is becoming ever more apparent. With the acquisitions of Instagram, Whatsapp and Move along with other product enhancements; our mobile experience, without us intentionally knowing is becoming more and more integrated through a Facebook platform. It will be interesting to watch the stock performance of FB over the next 18 months as we see mobile users interact with their Facebook mobile products in a similar manner to how Microsoft dominated our PC ecosystem in the 90s.

The evolution of the social web

The evolution of the social web over the past 24 months has been fascinating.

We are kind of witnessing a social revolution within the social revolution. Social web 2.0.

It looks like the world went perhaps too open too quickly and we have seen a revolt. Many young teenagers shifted their social network activity from Facebook to the more private sphere of Instagram and from there they moved to Snapchat, where your picture gets deleted in a flash, no one can see it, save it, archive it and share it around town.

We have witnessed a backlash against many aspects of the social network revolution that most of Generation Y were unhappy with. Facebook allowed people to share, to open up and connect with the world, but it restricted individuals from sharing privately in a fun social manner. Also Snowden exposing the NSA’s snooping of FB profiles undermined Facebook’s attempts to maintain user privacy as well as the implementation of new sharing rules without explicit user consent.

We have almost gone full circle. Secrets were bad in Silicon Valley, now they love them, with the Secret app taking Silicon Valley by storm in the past year. People are enjoying speaking in a social forum where there words cannot be traced back to them. Anonymous sharing is the new buzz happening on the social web. Trust is still the underlying ingredients in all these networks. Once this breaks down, then there will be no community and no exchange of these ideas.

People were once willing to listen to people who they were close to online and Facebook allowed the exchange of ideas through networks such as universities and schools. Now there is an exchange of ideas happening through anonymous peer to peer networks and many people are yearning for privacy. Will this connect us further or make us grow further apart?

2014: Still living in the 20th century?

Let’s cast our minds back to Peter Thiel’s Start-up Course that we teach here at eToro. Recent tragic events reminded me of this particular class.

It is now well over a month since flight MH170 disappeared from radar and has still not been found. Ignoring the conspiracy theories circling the web, assuming this plane is at the bottom of the ocean sea bed, how has nothing been recovered including the black box flight recorder?

Only last year we were told that there are no secrets, that governments can snoop on us, any time, anywhere. The truth was supposedly exposed. Here Ed Snowden, talks on TED about, ‘how we can take back the internet’.

The Malaysian plane tragically reminds us that there are a vast swathes of the earth unexplored, that the internet cannot track us down everywhere and that perhaps we often focus our innovation efforts in the wrong direction.

As mentioned we have remarkably been travelling at the same speed for 30 years. Aerospace has often been neglected in the wake of economic downturns. Governments are looking for a plane with naval and air support that was developed more than 30 years ago. It’s a shame that such tragic events remind us that we have not advanced technologically as much as we often like to claim.

It is a stark reminder that there are huge obstacles in the way of innovation. When Concorde came to market many thought this is how fast the masses would soon be travelling from continent to continent. This of course has not happened. Electric cars were the future 10 years ago, but I am still driving a regular petrol fuelled vehicle.

I am very excited about what the future holds: Google Glass and driverless cars coming to the market, but we should react with cautious optimism. Cynicism develops if we promise too much and raise expectation levels.

Great 2013! Now onto 2014…

I wanted to take the time to reflect on what has been a truely revolutionary year 2013.

I don’t think anyone, including myself, had dared to imagine what a year of change it would be for all of us.

At eToro we launched some exciting features; the eToro OpenBook for mobile devices (both IOS and Android users can now enjoy investing on the go!), a large stock offering that really made a difference in the way people approach investing, and of course worked harder than ever to continue improving our existing products such as the CopyTrader and the WebTrader.

We welcomed tens of thousands of new users to our platform in 2013. I’m excited to say that we’re seeing more and more people taking interest in their investments. I believe it’s safe to say now, when looking in retrospective that 2013 was the year where our vision became a reality, and the future of finance became the here and now.

The innovation taking place to disrupt the old, traditional order, that serves only a few has only just begun. 2013 was the year when the world opened its eyes to the emergence of Bitcoin and cryptocurrencies. Bitcoin is almost an ever present topic on Bloomberg and has risen from the geek underground to an acceptable form of currency. This emergence will bring about a more open and transparent world economy. It’s great to be a part of something that will truely change the world.

I am thrilled to face the challenges and opportunities 2014 will bring , I will continue to strive to innovate and socialise the experience of the financial world. This is what social is all about. It is the absolute expression of transparency. Keep on sharing your’ hopes, dreams and innovations.

eToro meets David Cameron, the British Prime Minister via Future Fifty

We recently were accepted into the Future Fifty programme- a UK governmental programme designed to accelerate a select group of high-growth stage tech. The formal event took place together with the Tech City 3rd anniversary.

We were welcomed in ceremonial fashion by being invited to open the world’s financial markets at the London Stock Exchange along with other entrepreneurs from the other chosen companies such as Zoppa, Shazam, Hailo, Swiftkey to mention a few of some of the great founders I met. Joanna Shields of Tech City and Xavier Rolet CEO of the London Stock Exchange hosted the event. The day got even better after Hailo cabs took us to the Tech City offices, where I had the opportunity to personally meet and shake hands with the British Prime Minister, David Cameron. He definitely liked the eToro t-shirt I was wearing, I should have brought him one 🙂

London is a great place for us to have an office as one of the world’s financial centres. With our office being at Level 39 where tech meets finance.

Being part of the Future50 allows us to be perfectly placed to accelerate our growth, to scale our user base in the UK; giving more people the chance to be part of a democratised world of finance.

10x